Ramirez hones devotion to legal advocacy with ArchCity

One day, while sitting in his “Social Inequality in America” class, St. Louis Fellow Brodhi Ramirez ‘27 listened to a teaching assistant discuss the role that the legal and social justice organization, ArchCity Defenders, played in the Ferguson Uprising. “I got chills for a minute, and that same day, I sent Jacki [Langum, Deputy Director of ArchCity] an email,” Ramirez said. Needless to say, he got the job. Ramirez spent the summer at ArchCity as a St. Louis Fellow, supporting their mission of providing pro bono legal and social services support to St. Louisans.

Barnes presents St. Louis Impact Fund results at Delmar DivINe

Mac Barnes ’26, a 2024 Transform Grant recipient of the Gephardt Institute’s St. Louis Impact Fund, unveiled his exhibit, “Quilts as Civic Engagement: An Interactive History of St. Louis and the Delmar Region,” on Wednesday, Dec. 18. Coinciding with the grand opening of WashU’s Community Engagement Office, located in Delmar DivINe at 5501 Delmar Blvd. in St. Louis’ Central West End, hundreds of visitors viewed and praised Barnes’ quilt, posed for photos and asked the WashU junior about his inspiration and process.

CAPS launches new program for lab techs

WashU’s School of Continuing & Professional Studies (CAPS) is launching a new program that prepares adult learners for high-demand jobs in medical and research laboratories. The program will create career pathways for workers and meet the needs of local businesses.

WashU’s economic impact totals $9.3 billion

WashU’s direct and indirect impact to the St. Louis economy in 2024 totaled $9.3 billion, an increase of $500 million from 2023. During fiscal year 2024, which concluded June 30, WashU spent $3.9 billion on salaries, construction and purchasing. That money rippled across the region, generating another $5.4 billion in economic activity. Chancellor Andrew D. Martin said WashU’s growing economic impact represents both its success as a global leader in education, research and innovation and its commitment to the region as an employer, health care provider and community resource.

Minton wins 2024 St. Louis ORBIE Award

Jessie Minton, vice chancellor for technology and chief information officer (CIO) at WashU, received the 2024 St. Louis ORBIE Award in the large enterprise category from St. LouisCIO Dec. 5. The award honors CIOs in the St. Louis region who have demonstrated excellence in technology leadership.

WashU launches advocacy program, impact map

As the 2025 legislative session kicks off, the Office of Government & Community Relations at Washington University in St. Louis has launched an advocacy program as well as an online map demonstrating WashU’s impact across the state.

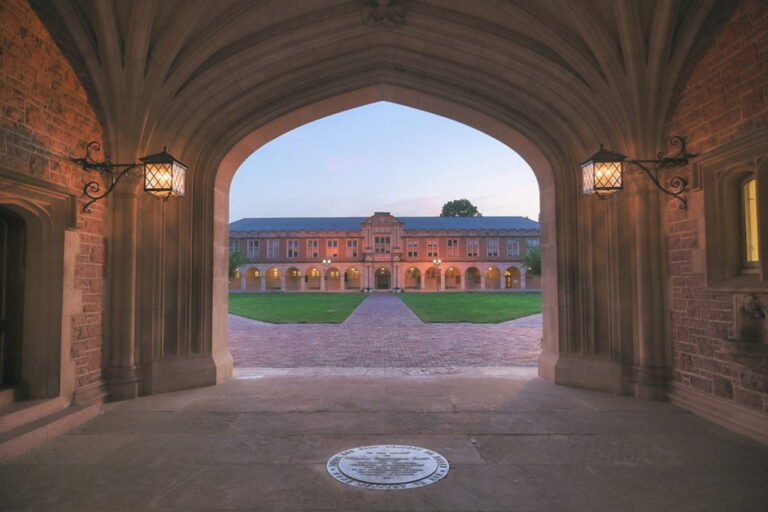

Fowler to be honored with Rosa L. Parks Award

Flint Fowler, a strong champion for St. Louis’ young people and a WashU alumnus, will receive the annual Rosa L. Parks Award at the 38th annual Dr. Martin Luther King Jr. Commemoration at 2 p.m. Monday, Jan. 20, in Graham Chapel at Washington University in St. Louis. Fowler retired in December from Boys & Girls Clubs of St. Louis, where he served as executive director for 28 years. During his tenure, he helped the organization grow from a single location to 11 sites in the region offering about 14,000 young people programs in leadership, academic success, career readiness, the arts and sports.

Rural student surprised with a WashU Pledge scholarship

Two summers ago, Angela Chen joined the first class of the Washington University Rural Scholars Academy, a free program that introduces talented high school students to all that WashU and St. Louis have to offer. Next fall, she is set to return — this time as a first-year student on a full-ride scholarship.

WashU partners with Greater St. Louis Marathon

WashU will once again partner with Greater St. Louis Marathon, a St. Louis tradition that features a marathon, half-marathon, marathon relay, 10K, 5K and 1-mile family fun run. The 2025 race will take place April 26 in downtown St. Louis.

Sam Fox School spring Public Lecture Series begins Jan. 24

Illustrator Carson Ellis, sculptor Beatriz Cortez and architect Rahul Mehrotra are among the internationally renowned creative professionals who will discuss their work for the Sam Fox School of Design & Visual Arts at Washington University in St. Louis this spring. These events are free and open to the public.